Local Government Laws on Workers Compensation Insurance: 5 Things that Vary from State-to-State

Susan Ranford is an expert on career coaching. business advice. and workplace rights. She has written for New York Jobs. IAmWire. and ZipJob. In her blogging and writing. she seeks to shed light on issues related to employment. business. and finance to help others understand different industries and find the right job fit for them – Strategics360.com/

Workers’ compensation is a sort of insurance providing medical benefits and wage replacement to injured workers. Any employee with work-related injuries that happened during their employment can use their employee rights to sue their employer for negligence, which frequently means their medical expenses are paid, they are paid for long term care, as well as being compensated for suffering and pain.

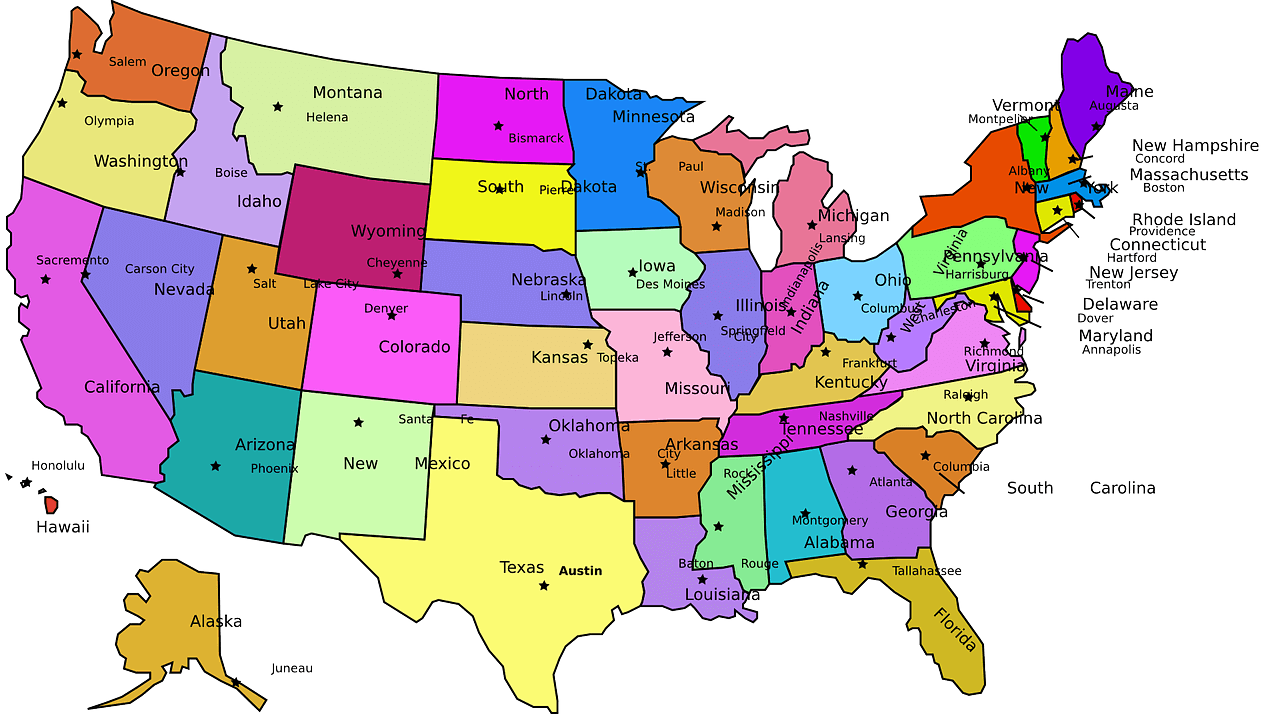

Businesses in most states are required to purchase workers’ compensation insurance. The laws for each state vary. Some states require every business to purchase coverage, while other states base their requirements on the number of employees they have hired. Texas and Oklahoma are the exceptions. These two states let their employers decide whether they want to purchase coverage or not.

According to the U.S. Bureau of Labor Statistics, as of December 18, 2019, State and local government compensation averaged $51.66 per hour worked. The employer’s cost for workers’ compensation is approximately $96.5 billion a year. The benefits that were paid out totals roughly $61.9 billion a year.

Monopolistic states do not allow private workers compensation insurers. A Monopolistic State Workers Compensation Fund is found in states that require employers to either obtain Workers Compensation Insurance from a state fund or identify themselves as self-insured. North Dakota, Wyoming, Ohio, and Washington are currently the only monopolistic states in the U.S. These states have banned private insurance companies from selling workers compensation coverage to businesses.

Each state’s requirement for workers’ compensation differs from the other states.

SUSAN RANFORD

Severe fines can be levied due to noncompliance. Trying to save money by not purchasing workers’ compensation insurance is a gamble most businesses can not afford to take. Businesses that refuse to purchase coverage can be fined for noncompliance by most states. For each state, the reason you were without coverage, the duration of noncompliance, and the number of employees will determine the amount of the fine.

5 Things That Vary from State to State

- Some states have competitive state funds, which allow employers to choose coverage through the state fund, private insurers, or self-insurance. South Carolina, Oklahoma, Maryland, Louisiana, and Kentucky all their state funds to set their own rates.

- 35 out of 50 states use the National Council on Compensation Insurance to calculate experience modification factors and promote their rate structures. Twelve states have their own independent rating bureaus, while four states have the state-operated monopolistic funding program, and Wisconsin has its own separate rating bureau. Wyoming and North Dakota, both monopolistic states, have workers compensation insurance through a state fund exclusively. Washington and Ohio allow self-insurance or the state fund, one or the other.

- The payroll basis varies from state to state. For Nevada, payroll over $35,000 is not covered when developing the premium. For North Dakota, it’s $31,800. South Dakota and Oregon do not include vacation pay in their calculations. Some of the states include full overtime payroll, while other states, such as Wisconsin, only include the straight time part of the salary.

- 40 out of 50 states have competitive ratings of workers compensation that the insurance company can credit or debit the published rates for certain businesses based on their forecasted claims activities. However, Wisconsin doesn’t have a competitive rating system; instead, to be more competitive, insurance companies can offer dividend plans.

- 25 out of 50 states include taxes and assessments in their rates to finance state special funds and workers’ compensation agencies. Whereas other states charge a different set of taxes and fees. And 20 states, Wisconsin included, have a contracting class premium adjustment.

5 State Specific Differences

Each state’s requirement for workers’ compensation differs from the other states. Here’s a rundown of some of the state-specific exceptions and highlights.

- Arkansas has a three-employees-or-more requirement for all industries except for the construction businesses. They are required to carry workers’ compensation even if they do not have any additional employees.

- Florida requires construction employers to carry workers’ compensation when they have one employee, which includes the owner. For non-construction industries, Florida requires workers compensations for employers with more than four employees.

- Maryland requires all employers to carry workers’ compensation, except for businesses with less than $15,000 in payroll and agricultural companies with less than three employees.

- Montana does not require umpires at amateur sporting events, officials, athletes in contact sports, ministers, and newspaper couriers to carry workers’ compensation.

- Texas gives each business a choice in whether to purchase workers’ compensation or not. However, Texas does have one exception to the law. Texas requires construction companies with government contracts to carry worker compensation insurance.

Conclusion

Filing a workers’ compensation claim is comparable to filing an insurance claim; it is not necessarily a lawsuit against the employer, but rather a request for benefits.

CAREER ADVICE

GOV TALK